Roman Garbar

May 3, 2023

Guest post by Martin Macmillan, CEO/Founder at Pollen VC

Hyper casual developers typically believe their only option is to work with publishers, primarily because the upfront capital needed to properly scale a game is so high. But with a better understanding of the financial dynamics of user acquisition in the mobile gaming industry, could studios self-publish their own hyper casual games without having to give most of their revenues away to a publisher?

Let’s see how we could get a bit smarter if we look at the numbers through a different lens.

There are two key points to consider:

1. ROAS breakeven period

How quickly does my game generate enough revenue to cover the upfront investment into ad spend?In a hyper casual game with good retention and game mechanics, this is generally measured in a matter of days.

2. Payout terms of the ad networks

How long is it before I actually receive the cash payout relating to the ad/IAP monetization from my game?How quickly can I take my revenues out as cash and reinvest back into UA to achieve that scale velocity?

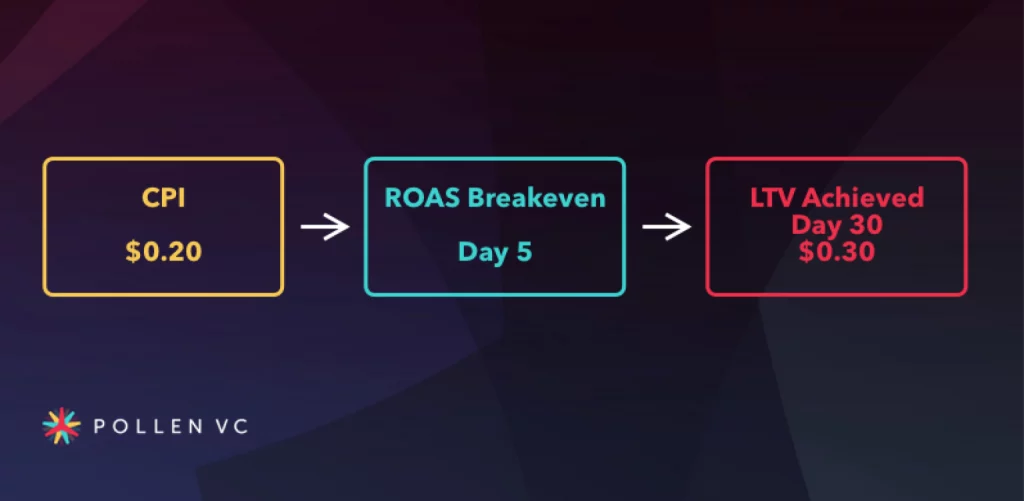

When planning to scale a hyper casual game it’s really important to consider the user acquisition or monetization parameters purely as an investment formula. You’re trying to figure out unit economics of a game based on its ability to monetize through keeping players engaged and serving them ads.

In other words, your $0.20 invested breaks even after 5 days, and goes on to make a profit of $0.10, realized after 30 days. This gives you 150% ROAS or 50% ROI after 30 days.

Once you’ve figured out the formula and believe you can scale, it all comes down to how much you can spend on user acquisition to rocket up the charts and make as much money as possible, before your UA investment equation breaks, and you can no longer spend profitably on UA at the same scale.

So if you were to spend a sustained $33,000 per day to scale your game, this would require around $1,000,000 of capital for the first 30 days. Either you need to have the cash sitting there upfront, or have a huge credit line with your chosen ad networks, to allow you to spend on ads without running out of cash/credit.

Of course, large credit facilities are normally only available to established publishers rather than for aspiring studios. This exacerbates the problem for hyper casual studios, often forcing them towards publishers to access the necessary capital/credit line to scale, whilst giving up a disproportionate revenue share to achieve it.

In addition to this, the payment terms of ad networks are often 45-60 days after the end of the period, which is longer than a traditional net 30 payment plan with the ad network credit facility – thus even an unlimited credit line would not solve the cash issue.

Now let’s ask a simple question.

“If I could access all the revenue from my game as cash I’d earned on the very next day, and use that funding to recycle into more UA, how much could I spend on ads in a month given my scaling budget of $50,000?”

The important point here is the shape of the ROAS/LTV curve, which will determine how quickly revenue is earned, and therefore how much capital can be accessed, and how fast it can then be reinvested into additional UA.

A revolving credit facility works by the lender digitally verifying the ad network and IAP data programmatically directly from source, then extending a line of credit against these earned revenues (receivables), and ultimately paying down the credit facility by receiving the inbound payments directly from the ad networks on their normal payout date.

Having access to the right capital in a timely way gives studios the ability to self-publish hyper casual titles without relying on publishers. Consider also that the bar for having a game published may drop. Metrics that are not considered sufficient for a top tier publisher can work for a self published studio where profit does not need to be shared, thus improving the profit margin by 2x, assuming a 50% publisher revenue share after ad spend.

Try this simple calculator to see your spending capability over a 30-60 day period given your ROAS profile and a starting budget amount.

Inputs required:

- ROAS/LTV curve up to d30

- Starting scale budget

- Avg payables days (payment terms of the ad networks)

- CPI

The calculator will then show the following outputs:

- Summary statistics

- Cumulative spend graph

- Cumulative profit/residual value

- Visualization of LTV Curve

Also check out this post Slicing up the hyper casual pie for better insights on how hyper casual developers can achieve self-publishing success.

Guest Author

Martin Macmillan is the Founder and CEO of Pollen VC. He has 20 years of experience in launching and building technology businesses in financial services and media sectors and a prior career as an investment banker. Having directly experienced the growth challenges facing tech start-ups and the lack of debt financing options open to early-stage technology businesses, he saw the opportunity to marry his traditional financial markets and technology experience to create a new financing model for the app and gaming economy.