Roman Garbar

January 16, 2024

Introduction

In this ‘From Hyper to Hybrid in 2024’ report, we investigate the evolving mobile gaming industry, with a special focus on the challenging journey of hyper-casual game developers as they strive to adopt a hybrid-casual approach. This shift represents a significant development in the mobile gaming industry, as developers blend the simplicity and accessibility of hyper-casual games, with more engaging game mechanics typical for casual games. A crucial aspect of this evolution is the monetization strategy. Traditionally, hyper-casual games relied predominantly on in-app advertising (IAA) for revenue. However, the hybrid model is unique in that it integrates in-app purchases (IAP) with IAA—creating a more diverse and potentially lucrative revenue stream.

Our analysis, drawing data from both hyper-casual and hybrid-casual games, covers the leading platforms, countries, and ad networks by ad spend, and compares the average cost per install (CPI) for each.

Note: This report will be updated periodically.

Last updated on 22nd January 2024.

Executive Summary

Platform comparison

Android vs iOS

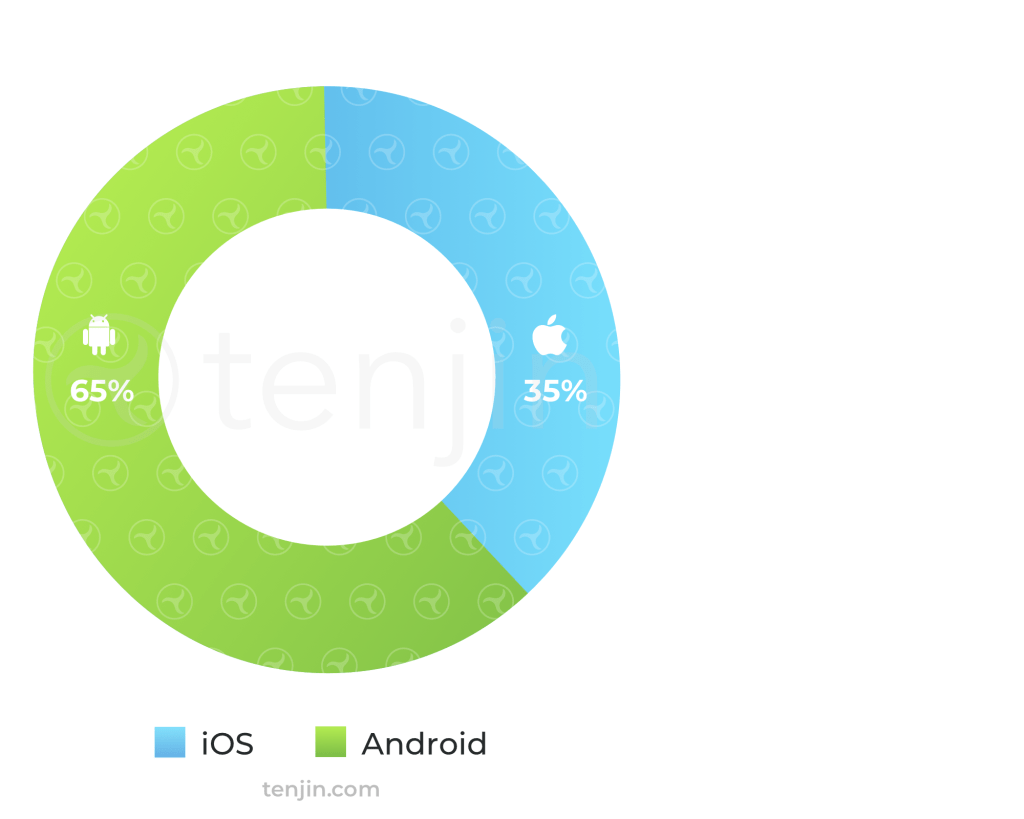

Ad Spend Share by Platform in 2023

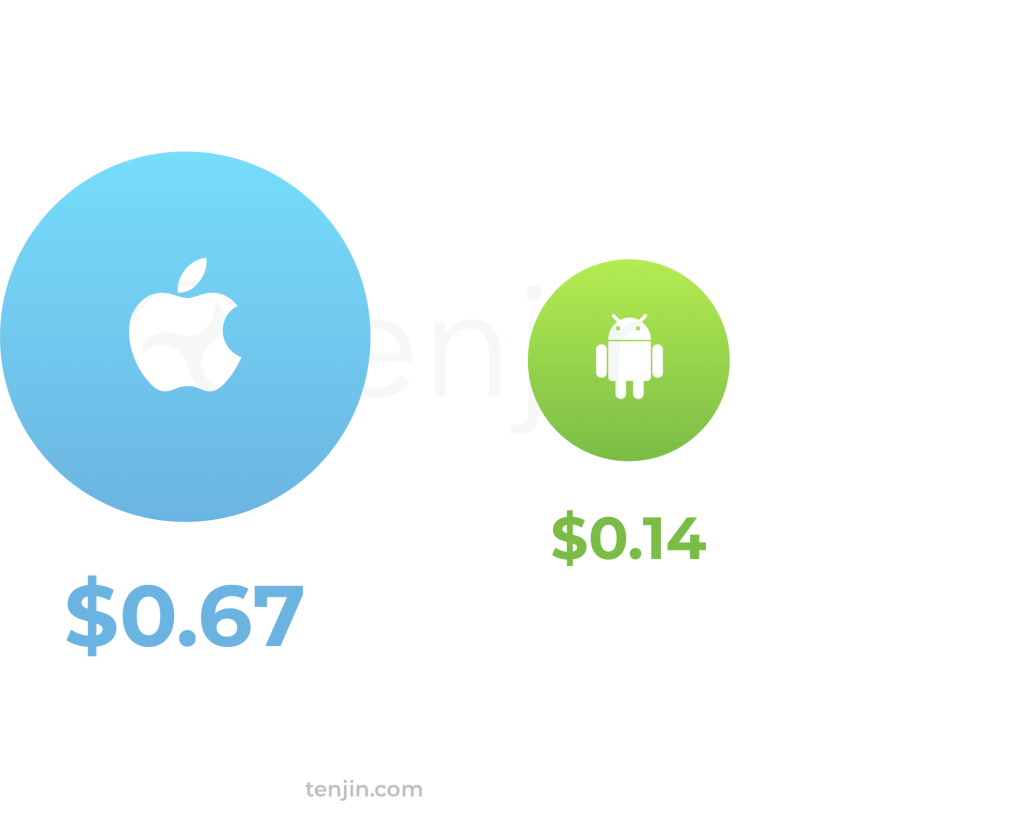

Average CPI by Platform in 2023

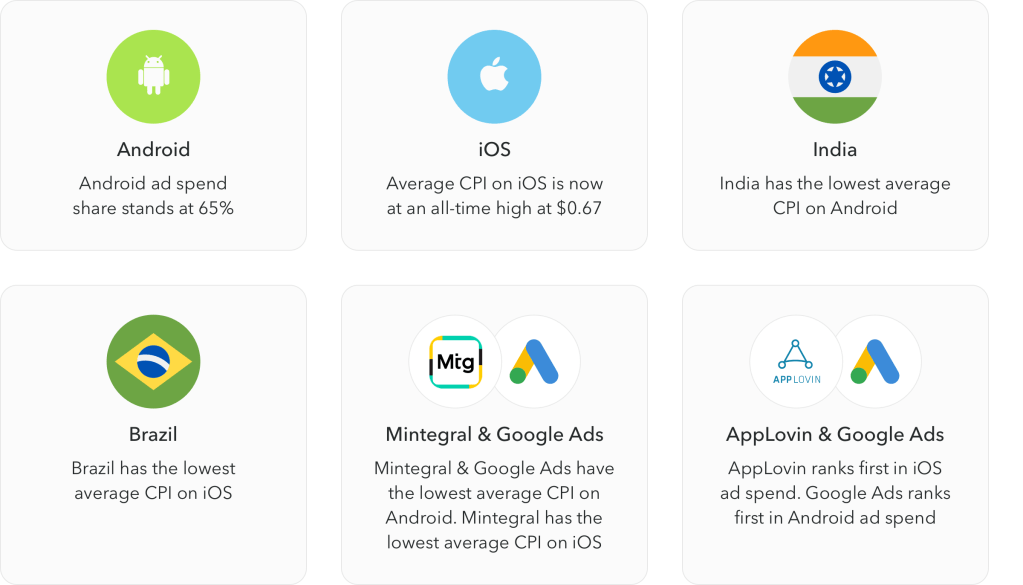

The share of ad spend on Android is on the rise, while the average CPI on Android has decreased compared to the fourth quarter of 2022 ($0.2). In contrast, the CPI on iOS has reached a record high.

Country Rankings

Top 10 Countries by Ad Spend in 2023

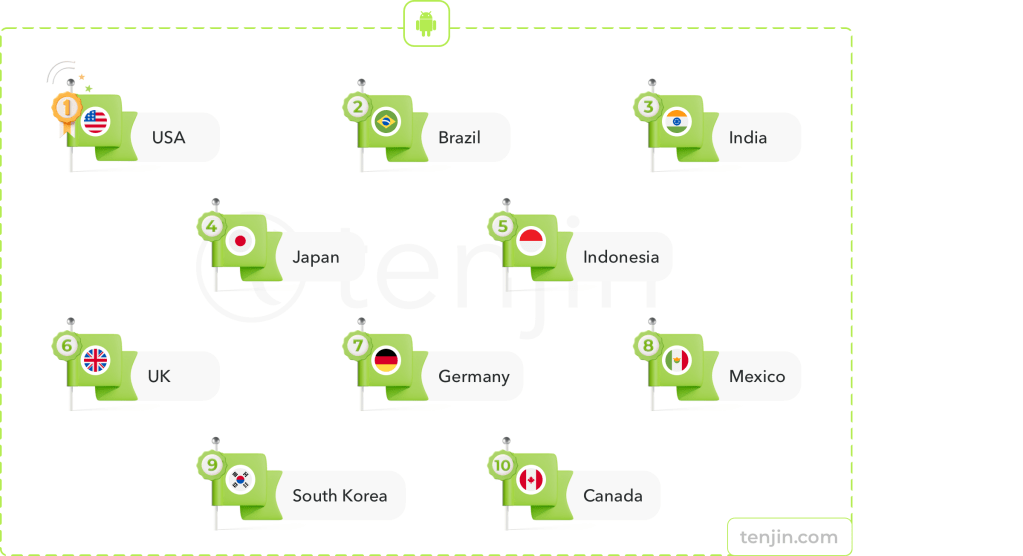

Android

It seems unlikely that any country will surpass the USA for the top position on both Android and iOS soon. Additionally, we can see that both hyper and hybrid publishers on Android prefer to spend in countries with low CPI such as Brazil, and India.

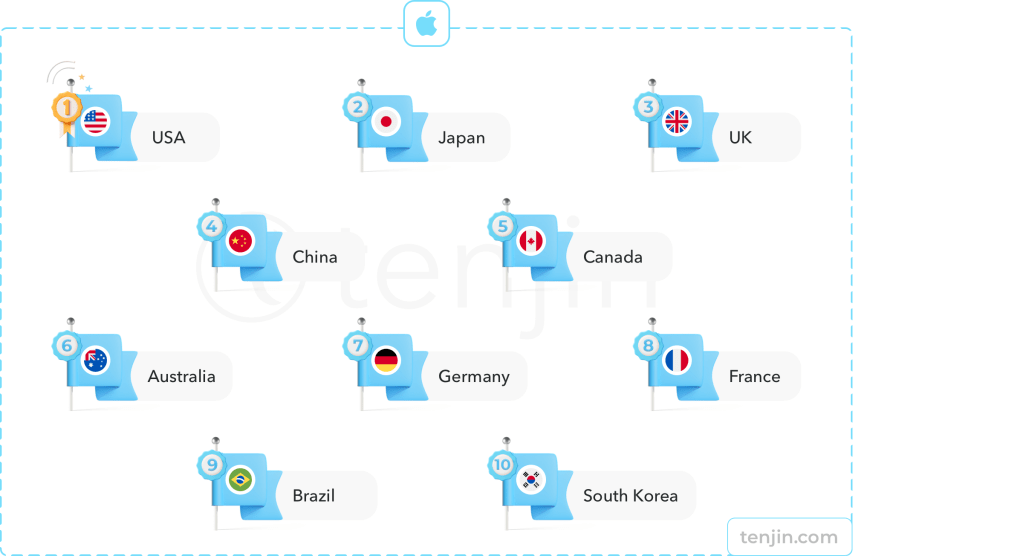

iOS

In comparison to our Q4 2022 ranking, China has ascended by three positions, while Brazil has entered the iOS ad spend ranking for the first time ever.

Average CPI for Top 10 Countries by Ad Spend in 2023

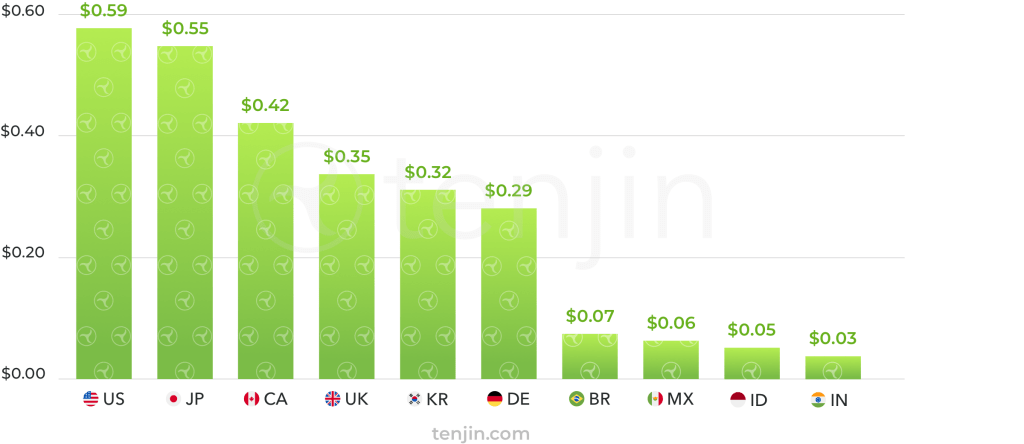

Android

Our data confirms that advertisers on Android choose between two approaches:

- Focusing on countries with low CPI such as Brazil, Mexico, Indonesia, and India

- Or concentrating on developed countries such as the USA, Japan, Canada, UK, Korea, and Germany

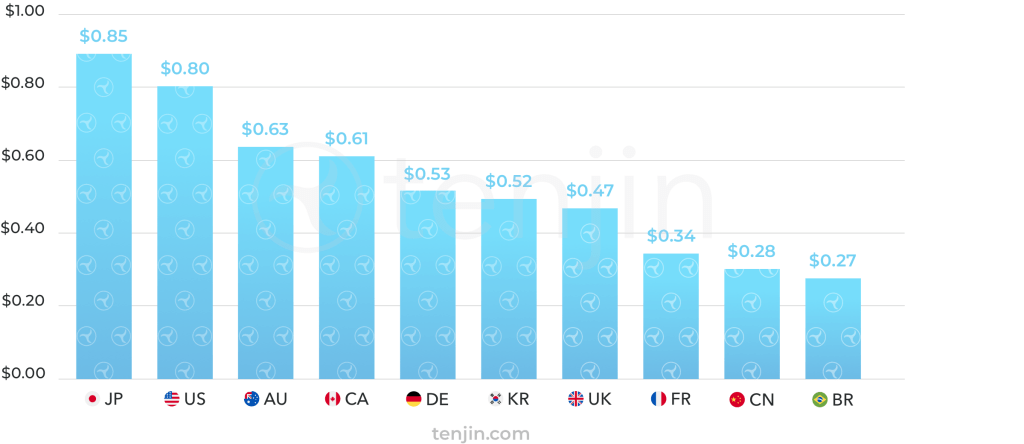

iOS

Despite having the highest CPI on iOS, Japan holds second position in the ‘Top 10 Countries by Ad Spend in 2023’ on iOS above. This ranking shows that advertisers are still keen on acquiring users at scale in Japan.

Ad Network Rankings

Top 5 Ad Networks by Ad Spend in 2023

Android

Google Ads has surpassed AppLovin to claim the top spot in the ad network ranking by ad spend on Android in 2023.

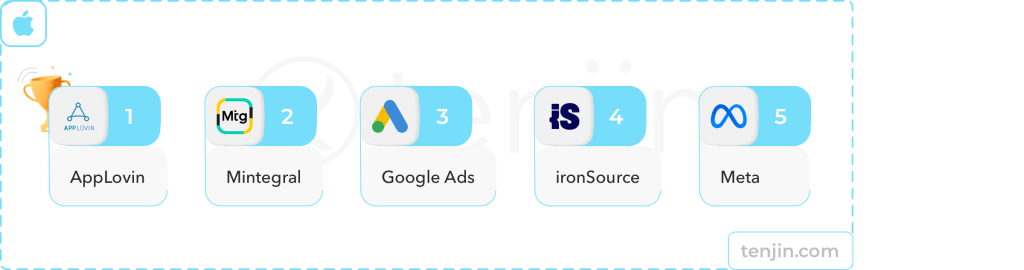

iOS

AppLovin maintains its position as the leading ad network by ad spend on iOS in 2023, mirroring its top spot from last year.

Average CPI for the Top 5 Ad Networks by Ad Spend in 2023

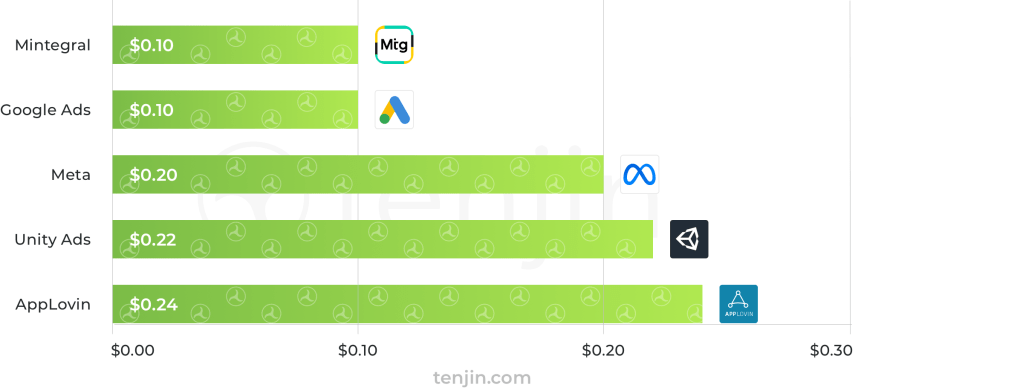

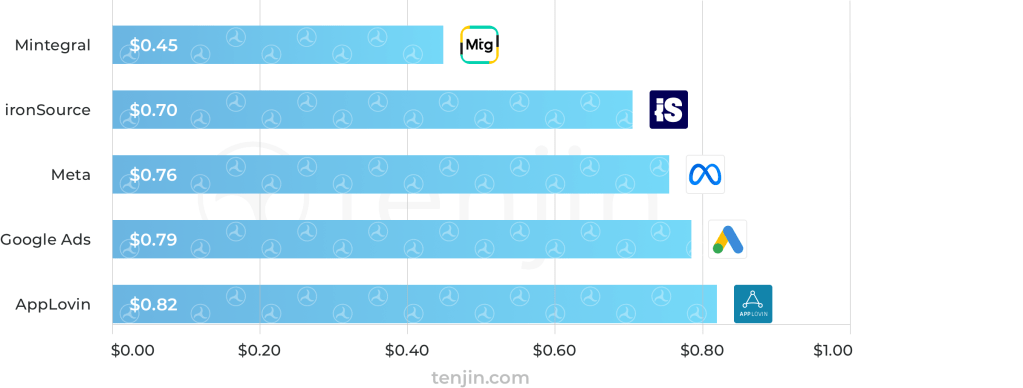

Android

Google Ads and Mintegral are the top choices for cost-effective ad networks in both hyper and hybrid casual games on Android. Mintegral maintained this position from last year.

iOS

The CPIs of the top 5 ad networks on iOS are closely clustered, except for Mintegral, which notably stands out. Interestingly, Mintegral also took the lead in 2020 with a CPI of $0.15.

Methodology

The report consists of anonymized data collected by Tenjin for hyper-casual and hybrid-casual games in the date range of 01.01.23 – 31.12.23. Only countries that surpassed the threshold of $1 million of ad spend were included in the country ranking.