Roman Garbar

September 4, 2019

At the 2019 ChinaJoy Seminar: Hyper-casual games in East meets West, our CEO Christopher Farm shared the most recent hyper-casual market analysis data and insights. Here are 4 key insights from the event:

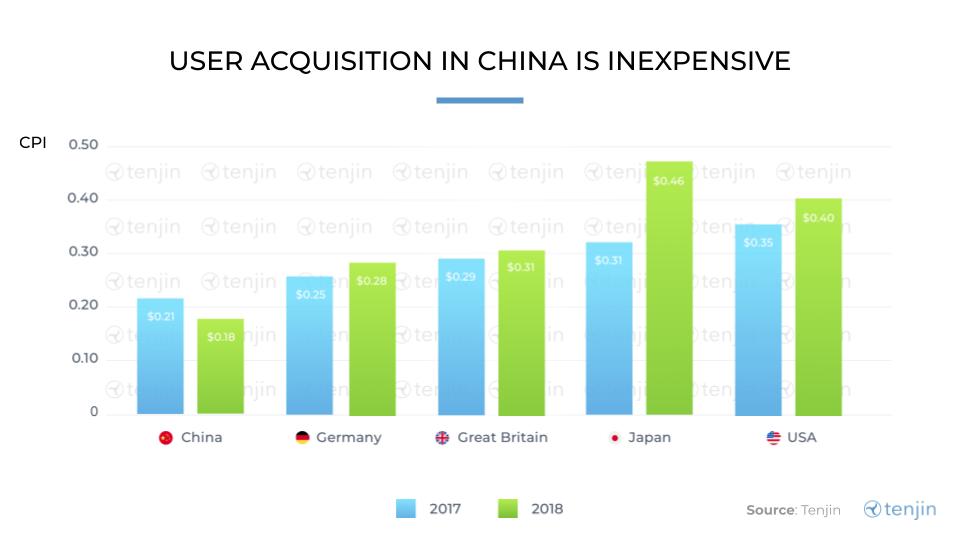

1. China’s low CPIs make it an attractive market

Hyper-casual games aren’t a western phenomenon. In fact, publishers are increasingly dedicating resources to acquiring new users in China and other eastern markets. Between 2017 and 2018, western hyper-casuals increased their Chinese user acquisition spend by 82%. What’s more, China is a cheap market to tap — the average cost-per-install dropped from $0.21 to $0.18 between 2017 and 2018, making an ideal launchpad for new hyper-casuals. Based on our data, we expect the Chinese hyper-casual market to grow even more in 2019. By 2020, it will be among the top three countries for launching new hyper-casual titles.

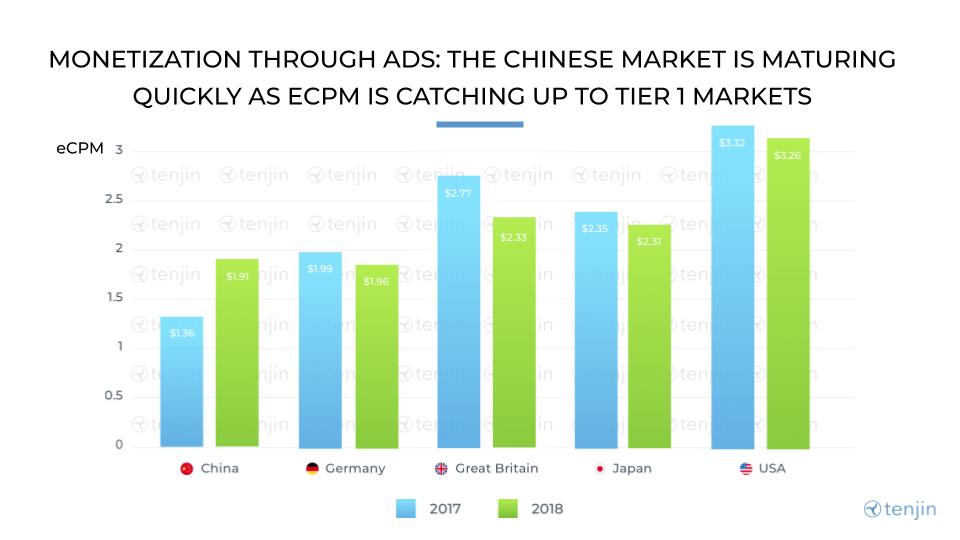

2. The Chinese market is maturing with respect to monetization

With respect to ad monetization, the Chinese market is maturing at a fast pace. As of 2018, the average eCPM in China reached $1.91, surpassing Germany. While the United States still leads in average eCPM, that market actually saw a slight drop between 2017 and 2018. The same is true of all other major markets, including Great Britain and Japan. We expect the Chinese market to continue to grow and mature throughout 2019, making it one of the most attractive countries for hyper-casuals seeking fast growth.

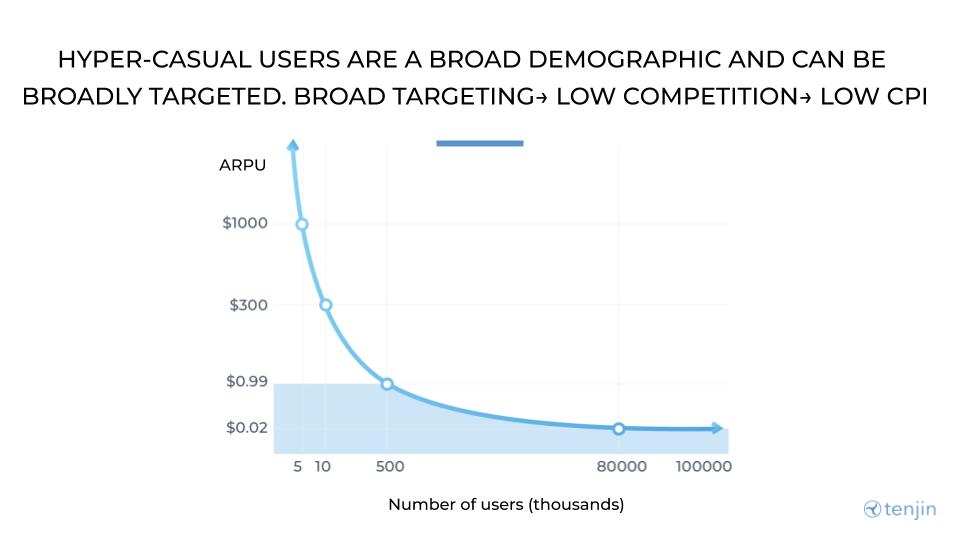

3. Hyper-casual user acquisition requires a unique strategy

Hyper-casuals require a unique user acquisition strategy — marketers can’t take the same approach as IAP games. Traditional UA requires narrow targeting because IAP-based games are all competing for the same pool of users at a high CPI. In the hyper-casual space, the benchmarks for average revenue per daily active user (ARPU) can be significantly lower. Therefore, hyper-casual marketers can target a broader, less competitive demographic at a lower CPI. Because high-value users are uncommon in the hyper-casual space, it’s crucial that these games cultivate a broad userbase that can be monetized through non-IAP channels.

4. Hyper-casuals have a short TTBE

Hyper-casuals are famous for their short time to break even (TTBE). In fact, a mere seven days after launch they often drive profit. To maintain this dynamic, hyper-casual developers must keep CPIs low. Growth, meanwhile, occurs on a longer time frame of 30 days or more. That’s because hyper-casual players typically aren’t loyal users with high LTV. Developers have to focus on maximizing users’ short term value through ad monetization. Fortunately, this pattern of short TTBE allows advertisers to act quickly.

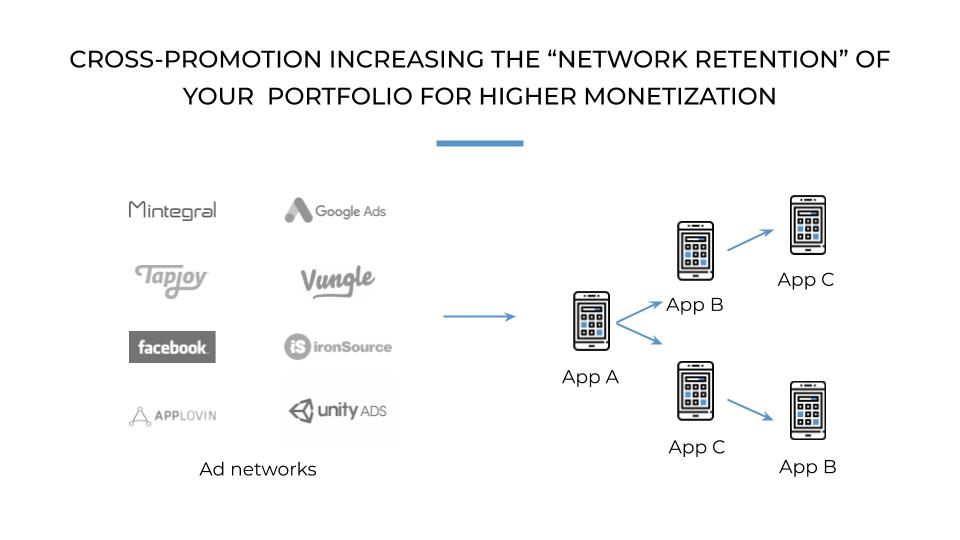

5. Cross-promotion increases “network retention” & ad revenue

Cross-promotion is a user acquisition tactic in which the users of one app are targeted in a campaign for a title produced by the same studio. The benefits of cross-promotion are two-fold for hyper-casuals: It increases retention across their network of titles and boosts monetization revenue. Ad networks will send supply to one app, which can then be leveraged across your entire portfolio. This snowball effect reduces churn and maximizes the value of each individual user.

Full version of the presentation is available on Slideshare.

Hyper-casual apps have unlocked a world of new potential in the mobile gaming space. Their popularity is surging globally, notably in non-western markets such as China. As the market continues to grow, UA and monetization strategies will need continuous recalibration. Tenjin’s customer success team is on the cutting edge of hyper-casual and can provide valuable data-driven insights to guide your success. If you need help carving out your niche in the hyper-casual space, feel free to reach out. Email info@tenjin.com to learn more, or check out additional resources like our complete hyper-casual developer’s guide.